When it comes to online loan apps, Tala Loan Philippines is definitely one of the best. Not only is the process professional and reliable, but the customer service is also excellent. I’ve had a great experience with Tala Loan so far and would definitely recommend it to anyone in need of a quick loan.

The best part about the online loan provider is that you can get your loan approved in just a few minutes, and the money is deposited directly into your bank account. If you’re looking for a hassle-free way to get a loan, Tala Loan is definitely the way to go.

Recommended Post: Home Credit Review: What You Need to Know Before Taking a Loan

Disclaimer: I am not affiliated with Tala Loan. This is not a paid review. This article is written from my own personal dealings with the company. However, if you wish for me to be your referer, you can click http://inv.re/g7fas

What is Tala Loan App and how does it work

If you’re looking for a quick and easy way to get a loan in the Philippines, then you should definitely check out Tala Loan. It’s an online loan app that makes it easy to apply for a loan and get the money you need within 24 hours.

Minimum loan: Php1,000

Maximum loan: Php15,000

All you need to do is download the app, sign up for an account, and complete the online application. Once you’re approved, you’ll get the money you need within 24 hours, straight to your bank account. Best of all, there are no hidden fees or charges, so you can be confident that you’re getting the best possible deal.

How to apply for Tala Loan?

Applying for a Tala loan in the Philippines is quick and easy, and no collateral or bank account is required. You can complete the entire process online in just a few minutes. All you need is some personal information, such as your name, address, and contact details, as well as a government-issued ID.

Government-issued IDs required by Tala

- Driver’s License

- Passport ID

- Postal ID

- PRC ID

- SSS ID

- UMID

- Voter’s ID

You’ll also need to provide a few contact references. Once you’ve submitted your application, you’ll usually receive a decision within minutes. If you’re approved, the money will be deposited directly into your account of choice so you can access it immediately.

Tala loans are a great way to get the cash you need when you need it, without having to go through any lengthy or complicated procedures.

From Tala FB Page

How to take a loan from Tala

If you’re looking to take out a loan in the Philippines, Tala is a great option. The application process is simple and straightforward, and you can get approved for a loan in just a few minutes. Here’s how to apply for a Tala loan:

1. Go to the Tala Loan app dashboard and click “APPLY NOW.”

You’ll need to answer a few quick questions about your loan and how are you going to use it. You’ll need to provide some financial information, such as your monthly income.

Note: The old application for a Tala loan was a little bit longer. Back then, you’ll be asked to describe how you’ll use the loan and for what purpose.

2. Once you’ve been approved to take a loan, you can choose an amount approved by Tala.

For first-time loaners, the minimum amount to loan is Php1,000 and the maximum is Php2,000. Over time, your loan amount will increase – that is, if you pay properly. Below is an example of what your approved loan will look like.

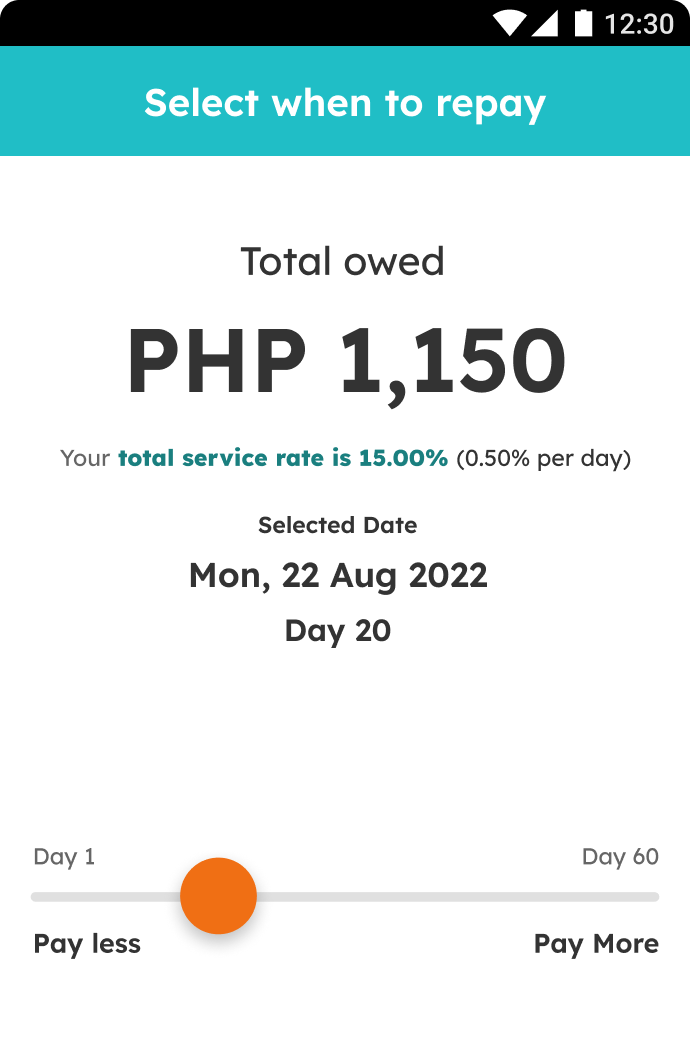

The interest rates vary over time – starting from 10% for 20 days and 30.5% for 61 days. It boils down to whichever payment date you choose.

3. Once you’ve submitted your application, you’ll receive a decision within minutes for cash out.

If you’re approved for a loan, the funds will be deposited into your account of choice within the specified time. It’s usually no longer than 24 hours – unless it’s done on a weekend or holiday.

Cash-out options:

- Bank of choice

- Cebuana Lhuillier

- Coins.Ph

- M Lhuillier

- Palawan Express

Wait for an SMS that will include your loan details. Cashouts are often done on bank days. There will be no disbursement of loans on weekends and holidays.

Applying for a Tala loan is quick and easy, and you could have the money you need in no time at all. So if you’re in the market for a loan, be sure to check out Tala.

How and where to pay your Tala loan

If you need to take out a loan from Tala Philippines, there are a few different ways that you can pay the amount back.

- First, you can click on the “Make A Payment” button on the Tala app home page.

- From there, you’ll enter the amount that you need to pay back and submit it.

- Once you’ve done that, you’ll be able to select your preferred payment method.

You can choose to pay Tala back through different payment methods.

- 7-Eleven

- Cebuana Lhuillier

- Coins.ph

- GCash

- M Lhuillier

- PayMaya

Wait for an SMS message with your payment details. Please only use our authorized payment methods and make sure to get your reference number from the Tala app.

Remember to pay early to avoid incurring late payment rates. You can view your payment schedule in the app so you can plan ahead. If you have any questions, our customer service team is always happy to help.

The pros of Tala Loan App

When it comes to online loans, Tala Loan App is one of the best options out there. The application process is easy and you can receive your loan within minutes. Plus, the interest rates are reasonable and the payment terms are flexible.

But the best part about Tala is the community and customer service. They are always ready to help and support you, no matter what your financial situation may be.

Whether you need a little extra cash for an emergency expense or you’re looking to consolidate your debt, Tala Loan App can help. So why not give them a try?

My Tala Loan Review

It was in 2017 when I first applied for an online loan through the Tala app. I was a little hesitant at first, but the process was quick and easy. I received the money within 24 hours, and I was able to repay the loan early with no penalty.

Overall, I was very pleased with the experience. The interest rate was lower than what I expected, and I will definitely use the Tala app again in the future.

Loan Application: 5/5

Applying for a loan with Tala is easy, fast, and hassle-free. You can apply online in just a few minutes, and you’ll get an instant decision. There’s no need to fax or email any documents, and you can get your money in minutes or the next business day. Plus, there are no hidden fees or prepayment penalties.

I think it’s a lot better this time with their new updates. Before, loaning an amount would entail a short description from you on how would you use the amount. Right now, the loaning process was cut a little shorter.

Paying Tala Loan: 4/5

Tala Loan is a great online loan service. They offer a one-time bulk payment and my experience with them has been great. The only thing I don’t like is the limited channels they have for payments. I would like to see more options for payments, such as by installment – they make it as a last resort.

I understand that they may not want to offer this option to everyone, but I think it would be helpful for those of us who have a hard time catching up with our payments. Overall, Tala Loan is a great service and I would recommend them to anyone looking for an online loan.

Customer Service: 100/5 (5/5)

Tala Loan has definitely the best online customer service as a loaning company in the Philippines. The online staff are courteous and helpful. They understand the need of their customers right away and answer their queries right away or within 24 hours.

The staff are also able to provide critical insights about the Tala Loan products which helps the customers know more about what they are availing of. Definitely, online customer service is one of the areas where Tala Loan shines the most.

The best experience I had with them was when I paid Tala a little bit late. It was the onset of COVID-19 and money was tight. Like I said above, they were able to stretch my payment by installments. This option happens to be their last resort.

Loan details: 5/5

Tala Loan provides good loan details of the amount you are borrowing – it’s simple and straightforward, and you can typically get your money within 24 hours depending on the channel you’re using. The fees are hefty though, so it’s important to be sure that you can afford the repayments before taking out a loan.

Communication: 5/5

Tala Loan is a great company to work with. They respond promptly and when they can’t answer right away, the answers come within 24 hours! I never had any problems communicating via email or app chat either so it’s really easy going here.

The customer service from Tala Loan has been amazing. Every time I’ve needed help something answered our questions quickly without ever being pesky about it.

Some online loans are borderline pesky, intrusive, and threatening! But you can do something about that. You can actually report them online.

With Tala, you don’t have to worry about it. They won’t even call your friends and family if you’ve made a late payment.

Tala Loan FAQs

If you’re considering getting a Tala loan, you may have some questions. We’ll go over the most commonly asked questions about Tala loans. You can even visit their FAQs page or message them directly through the app.

What if you can’t pay your Tala loan on time?

If you do not make any payments to Tala by the due date, Tala will charge you a Late Fee. This fee will be communicated to you and will be shown in the App. If you do not pay your loan by your due date, you will have to pay an additional 5% penalty on top of your existing loan balance.

Likewise, Tala’s debt collector will try to contact you and make payment arrangements. No payment after several attempts may affect your credit score with Tala Philippines and the Credit Information Corporation (CIC).

How can you increase your Tala loan limits?

SIMPLE. You pay on time!

Also, you need to give them good background info about you and how you handle your finances. This starts from the very beginning when applying to Tala Loan. How will you use the loan? Can you pay on time? How much are you earning? Do you have the ability to pay your loan? Etc.

Will Tala contact my friends and family?

They actually don’t!

Can you pay your Tala loan in installments?

They did this to me as a last resort. With their new updates, they allow errant payers to pay by installments as long as you meet them on your due dates.

Can you apply for a new Tala loan if you still have a remaining balance?

Nope! You need to pay in full before you acquire a new loan.

Tala Loan Overall score: 4.8/5

Online loan applications are revolutionizing the way people access to credit. Tala Loan App is one of the most popular online lenders, and it deserves to be number #1.

The application process is simple and straightforward, and the interest rates are very competitive. In addition, the flexible repayment options make it easy to manage your loan.

However, there are a few things that need improvement. For instance, more payment channels would benefit users.

Communication and customer service are Tala’s greatest assets. You can contact them directly if you have any questions or concerns. Additionally, there is transparency in terms of fees and charges. Overall, Tala Loan App is a great online lender, and I would recommend it to anyone looking for a loan.